Landowner Resources

INTERESTED IN CONSERVATION EASEMENTS?

CCALT founder and Steamboat rancher Jay Fetcher said, “You shouldn’t even be considering a conservation easement unless two things have happened: 1) you’ve run the numbers and it makes financial sense for you and your family; and 2) you feel in your heart it’s the right thing to do.” This section of our site is designed to help landowners and their families decide if a conservation easement with CCALT is right for them.

Landowner Questionnaire

Landowners who would like to conserve their land with CCALT must complete a project application, which provides CCALT staff and board of directors with the necessary information to begin the conservation easement process.

Landowner Testimonials

Hear from landowners who have conserved their land through an easement with CCALT. Learn more about their perspective on the process and what it has meant for their families and agricultural operations.

The Conservation Easement Process

Conveying a conservation easement can be a complicated process. The documents below will guide landowners through the process step-by-step in an easy to digest format.

Frequently Asked Questions

(Including Financial Incentives)

Over the past few decades, CCALT has compiled a list of the most frequently asked questions related to conservation easements.

Conservation offers landowners several tax incentives along with a number of financial and non-financial benefits. This document also answers questions about the costs and benefits of conservation easements.

Is My Land Eligible for a Conservation Easement?

CCALT considers two sets of criteria to determine if a property qualifies for a conservation easement: 1) state and federal guidelines; and, 2) CCALT’s own internal guidelines.

Conservation Easement packet

CCALT has assembled the necessary information to guide landowners through the process of determining if conservation is a viable option for their land and their family. This packet includes information related to the costs and benefits of conservation easements, a step-by-step guide to completing a conservation easement, and a number of other resources.

Myths & Facts

CCALT’s mission is to serve as a resource for landowners who voluntarily choose to conserve their farm or ranch. Our landowners are typically motivated by a love of the land, a desire to see it stay in agriculture, a wish to maintain open spaces and native wildlife habitats, and a strong will to pass their legacy on to future generations.

Conservation easements aren’t for everyone or for every piece of property. But for those who are interested, this section addresses some of the common myths surrounding conservation easements so landowners can make a more informed decision about what is right for their land and their families.

RESOURCES FOR LANDOWNERS WITH EASEMENTS

Our primary objective is to provide the members of the Colorado Cattlemen’s Association (CCA) and other agricultural producers with a conservation option that understands working agricultural operations and agricultural families. CCALT takes great pride in being the only conservation organization in Colorado that focuses exclusively on agricultural lands managed by agricultural families.

This section of our site is designed to provide landowners whose property is protected with a CCALT-held easement with important information related to their partnership with CCALT.

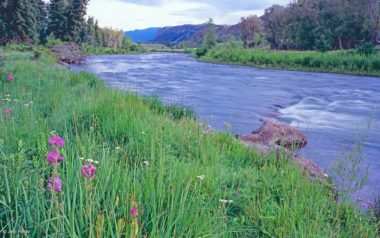

Additive Conservation Program

In December 2020, CCALT launched the Additive Conservation Program. CCALT understands it is critical to support landowners and communities in the maintenance, restoration, and enhancement of working lands and the natural resources they possess. The program will enable CCALT to work with and support landowners who have already conserved their properties to implement projects that support long-term stewardship goals and conservation values. These projects will have multifaceted objectives that support both operational and ecological needs. Example projects may include: fire mitigation, river restoration, habitat enhancement, grassland improvement, and water infrastructure upgrades. The program is also developing opportunities for working landowners to access ecosystem service markets. Such markets can increase and diversify revenue streams for landowners interested in conservation, and adequately incentivize management practices that support a property’s conservation values. Examples include the development of carbon offset credits and the establishment of wetland mitigation banks.

Please reach out if you have a project that would be a good fit for the Additive Conservation Program.

Please contact Megan Knott for more information about the following resources. Phone: 732-208-6548. Email: megan@ccalt.org